Credit Reports are Your Presentation Cards to Financial Institutions. Stay on Top of Them.

Keep track of your credit score by giving Personal Loans a call. We will teach you how to check your credit reports.

A credit report is an organized list of the information in your credit file. This file is compiled by all of the credit and loan companies you work with. Whenever you make a payment on a credit card or loan, the company will keep a record of how much and how often you pay.

Each company will then report back to the major Credit Bureaus regarding your credit, loan and payment history.

Always look closely at your credit reports and look for errors that may be affecting them.

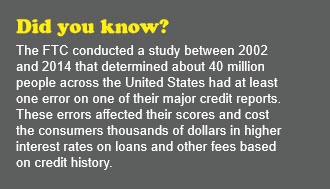

There are millions of errors on credit reports. The wrong date, spelling, name, status, or age will affect your credit history.

At times, simple reporting errors done by credit bureaus, creditors or collection agencies will limit your access to credit sources. Hence the need to keep an eye on them at all times.

For that reason, you should continuously monitor your credit scores.

Learn about the the Major Credit Bureaus, what they do and how they collect information.

Additionally learn what your FICO Score is and what to do to improve it. it will make the difference between getting better interest on loans, credit cards and mortgages.

Knowing what to do will vastly improve the quality of your loans, hence, your lifestyle too.

Our team can teach you how to get a free credit report for you. Submit a request on this website to secure your credit reports. It will go through almost immediately.

You can also do it over the phone. Therefore, get started and contact us today, you’ll be glad you did.

Finally, checking your credit reports makes perfect sense. Do it now!